Buyer's Stamp Duty (BSD)

Source: IRAS

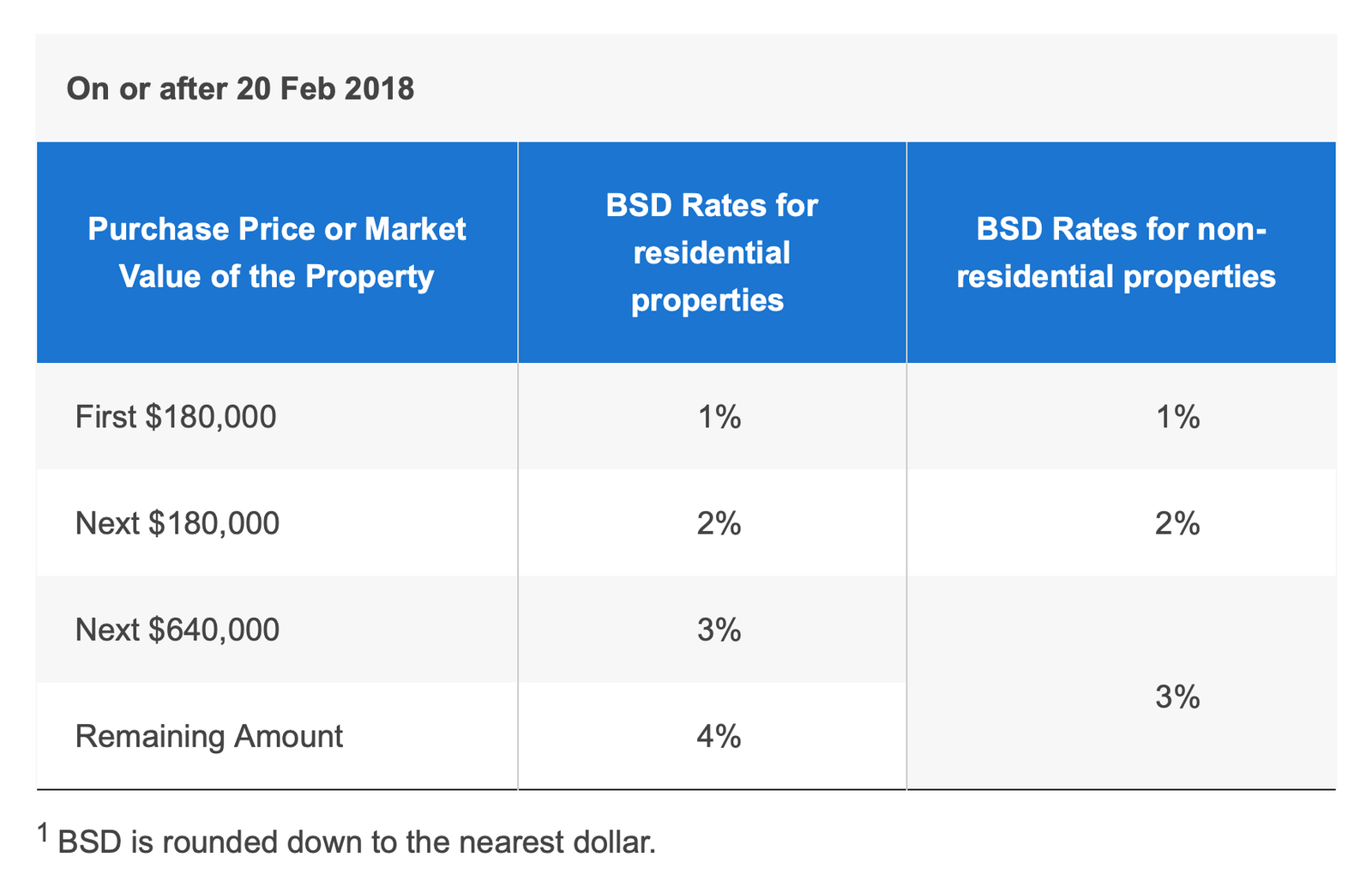

You are required to pay Buyer’s Stamp Duty (BSD) for documents executed for the sale and purchase of property located in Singapore. BSD will be computed on the purchase price as stated in the document to be stamped or market value of the property (whichever is the higher amount).

A quick way to calculate the BSD for a property which purchase price is S$1,000,000 or below, simply take the purchase price, multiply by 3% (0.03) and minus 5,400.

Should the property price is more than S$1,000,000, the formula would be purchase price multiply by 4% (0.04) and minus 15,400.

To confirm the BSD amount, you could also use the IRAS Stamp Duty Calculator.